Privacy Policy

Use of Personal Data

This document sets out the basis for our handling and processing of Personal Data.

Personal Data means any information relating to an identifiable person who can be directly or indirectly identified in particular by reference to an identifier.

How we use your information

In order to process your application we need to perform credit and identity checks on you with one or more credit reference agencies (“CRAs.”) To do this, we will supply your personal information to CRAs and they will give us information in return about you, your financial situation and financial history. When CRAs receive a search from us they will place a search footprint on your credit file that may be seen by other lenders. CRAs will supply to us both public (including electoral register) and shared credit, financial situation and financial history information as well as fraud prevention information.

We will use this information to:

• Assess your creditworthiness and whether you can afford a product;

• Verify the accuracy of the data you have provided to us;

• Prevent criminal activity, fraud and money laundering;

• Manage your account(s);

• Trace and recover debts; and

• Ensure any offers provided to you are appropriate to your circumstances.

If you make joint application we will link your records together, so you should make sure you discuss this with your partner/spouse/financial associate and share this information with them before lodging the application. CRAs will also link your records together and these links will remain on your file and theirs until such time as you or your partner successfully files for a disassociation with the CRAs to break that link.

We will continue to exchange information about you with CRAs while you have a relationship with us. We will also inform the CRAs about any settled accounts. If you borrow and do not repay in full or on time CRAs will record the outstanding debt. This information may be supplied to other organisations by CRAs. We will retain information on our files for a period of six years after your relationship with us comes to an end.

Identities of the CRAs, their role as fraud prevention agencies, the data they hold, the ways in which they use and share personal information, data retention periods and your data protection rights with them are explained in a Credit Reference Agency Information Notice (“CRAIN”) more detail of which can be found at www.equifax.co.uk/crain. CRAIN is accessible from each of the three CRAs – Equifax, Experian and Callcredit.

We will not disclose any personal information to any company outside the Weatherbys Group, which includes Arkle Finance Limited and Weatherbys Bank Limited, except to introducers with whom we share data, CRAs as indicated above and to help prevent fraud, service providers like law firms and asset managers who may help us administer and fulfil our contract(s) with you, or if we are required to do so by law.

You can find a full copy of the Privacy Policy of our parent company at www.weatherbys.bank/privacy-policy.

Fair Processing Notice

General

1. Before we provide services, goods or financing to you, we undertake checks for the purposes of preventing fraud and money laundering, and to verify your identity. These checks require us to process personal data about you.

2. The personal data you have provided, we have collected from you, or we have received from third parties will be used to prevent fraud and money laundering, and to verify your identity.

3. Details of the personal information that will be processed include, for example: name, address, date of birth, contact details, financial information, employment details, device identifiers including IP address and asset/ vehicle details.

4. We and fraud prevention agencies may also enable law enforcement agencies to access and use your personal data to detect, investigate and prevent crime.

5. We process your personal data on the basis that we have a legitimate interest in preventing fraud and money laundering, and to verify identity, in order to protect our business and to comply with laws that apply to us. Such processing is also a contractual requirement of the services or financing you have requested.

6. Fraud prevention agencies can hold your personal data for different periods of time, and if you are considered to pose a fraud or money laundering risk, your data can be held for up to six years.

Consequences of Processing

7. If we, or a fraud prevention agency, determine that you pose a fraud or money laundering risk, we may refuse to provide the services or financing you have requested, or to employ you, or we may stop providing existing services to you.

8. A record of any fraud or money laundering risk will be retained by the fraud prevention agencies and may result in others refusing to provide you with services, financing or employment to you. If you have any questions about this, please contact us on the details below.

Data Transfers

9. Fraud prevention agencies may allow the transfer of your personal data outside of the UK. This may be to a country where the UK Government has decided that your data will be protected to UK standards, but if the transfer is to another type of country, then the fraud prevention agencies will ensure your data continues to be protected by ensuring appropriate safeguards are in place.

Your Rights

10. Your personal data is protected by legal rights, which include your rights to object to our processing of your personal data, request that your personal data is erased or corrected, and request access to your personal data.

11. For more information or to exercise your data protection rights, please contact us on 01933 824500 or email us at customerservices@arklefinance.co.uk. You may also write to us at Arkle Finance Limited, 52-60 Sanders Road, Wellingborough, Northamptonshire, NN8 4BX.

12. You also have a right to complain to the Information Commissioner’s Office, which regulates the processing of personal data.

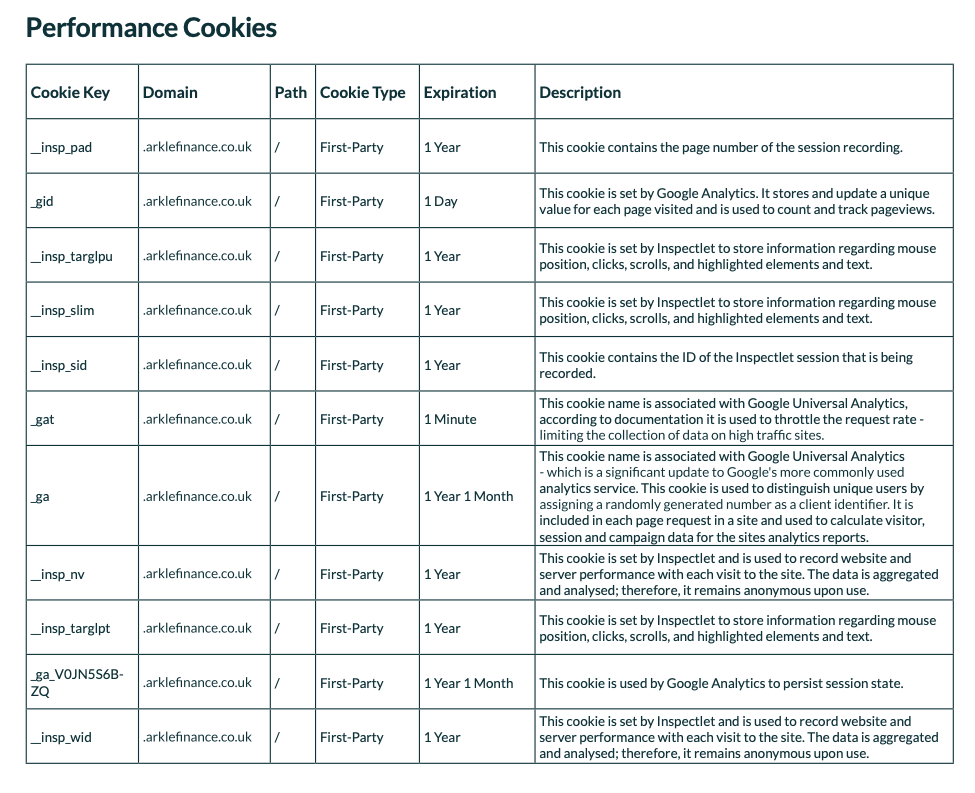

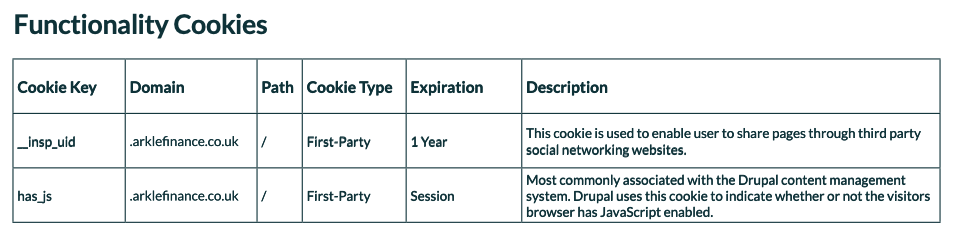

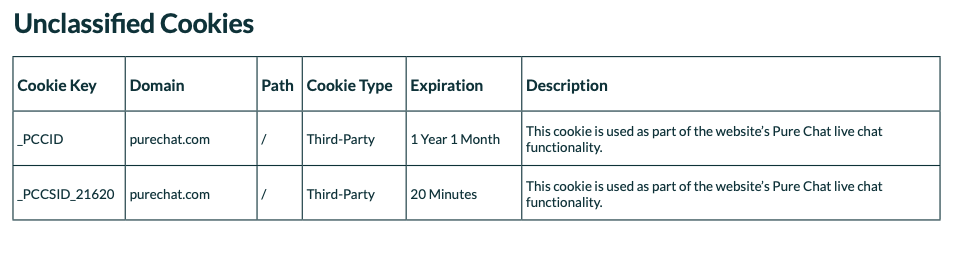

Cookies

We may use information about your general internet usage by using a cookie file which is stored on the hard drive of your computer or device. Cookies contain information that is transferred to your computer or device’s hard drive. They help us to improve our site and to deliver a better and more personalised service. They enable us:

- To estimate our audience size and usage pattern

- To store information about your preferences, and so allow us to customise our site according to your individual interests

- To speed up your searches

- For security

- To recognise you when you return to our site Additionally, data from Google’s systems is used for online advertising purposes. This is anonymised data on user location, search history, YouTube history and data from Google Partner sites provided by Google. Ads Personalisation is enabled by default in Google accounts, and you can opt-out at any time. You can also access and/or delete your data by visiting your Google account at My Activity. To learn more about Google uses this information, visit this link.

As well as Google, any data provided to Microsoft is used similarly for online advertising purposes. You can switch off personalised ad tracking on Microsoft Bing by selecting ‘settings’ and ‘personalisation’ from the bing.com homepage.

You may refuse to accept cookies by activating the setting on your browser, which allows you to refuse the setting of cookies. However, if you select this setting you may be unable to access certain parts of our site. Unless you have adjusted your browser setting so that it will refuse cookies, our system will issue cookies when you log on to our site.

Why we collect your personal data and the lawful basis we rely on to process it:

To fulfil a contract we have with you; or

• When it is needed to comply with our legal duty; or

• When it is in our legitimate interest; or

• When you give us your consent.

You can obtain further information on how your data is used, how we maintain the

security of your information and your rights of access to information we hold on

the full copy of the Privacy Policy of our parent company at

www.weatherbys.bank/privacy-policy

This includes ways to contact our Data Protection Officer.